In this case the principal amount remains the same as the loan is paid off. Enter the interest rate and two more fields, then press the button next to the field to calculate. Loan Calculator with Compounding so that the interest rate is calculated in terms of payments.įixed principal payments. If payment and compounding frequency do not coincide, you should use the Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Compounding This calculator assumes that compounding coincides with payments. Payment Frequency How often is the loan payment due? Typically loan payments are due monthly, but several options are provided on the calculator. Number of Payments The total number of payments, initial or remaining, to pay off the given loan amount. Estimated payments do not include amounts for taxes and insurance premiums.

Annual payment mortgage calculator full#

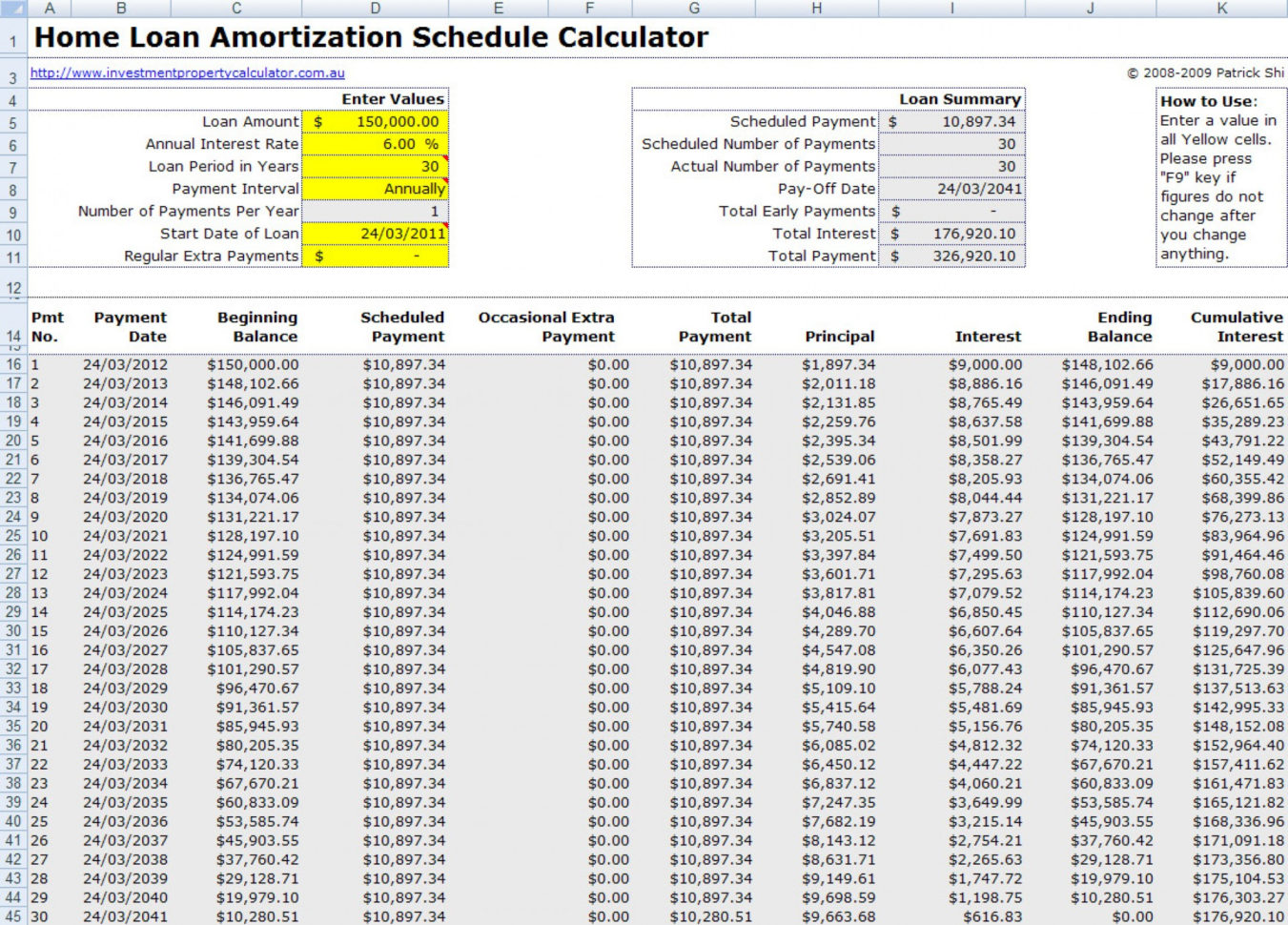

Interest Rate The annual stated rate of the loan. Press the Report button for a full yearly or monthly amortization schedule. Loan Amount The size or value of the loan. MPP r (1+r)n/ (1+r)n-1 MP monthly payment. For the matter of simplicity, we represent here a simplified version of the equation that doesnt incorporate all features involved in the calculator.

Annual payment mortgage calculator how to#

Increases over time, and the portion applied to interestĭecreases because you owe less principal. If you would like to know how to calculate a mortgage payment on your own, the equation is the following. The payment amount is the same over the life of the loan but the way the payment is applied changes: the portion of the payment applied toward the principal Most typical car loans and mortgages have an amortization schedule with equal payment installments. With each payment the principal owed is reduced and this results in a decreasing interest due. You can see that the payment amount stays the same over the course of the mortgage. Use our mortgage calculator to calculate monthly payment along with Taxes, Insurance, PMI, HOA & Extra Payments on your home mortgage loan in the U.S. Enter these values into the calculator and click "Calculate" to produce an amortized schedule of monthly loan payments. Say you are taking out a mortgage for $275,000 at 4.875% interest for 30 years (360 payments, made monthly). Payment Amount = Principal Amount + Interest Amount The amortization table shows how each payment is applied to the principal balance and the interest owed.

The results given by this monthly mortgage calculator are only a guide.This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. Please speak to an independent financial advisor for any kind of advice on mortgages Note: The home loan information shown above is provided for information purposes only. If you're considering refinancing an existing mortgage, please use the mortgage refinance calculator. Mortgage Payment Calculator Mortgage Amount Mortgage Term Interest Rate per year Taxes per year Insurance per year Answer: Monthly Principal + Interest: 848.14 Monthly Tax: 266.67 Monthly Insurance: 43.33 Total Monthly Payment: 1,158. Initial value of the loan is still outstanding. So, at the end of your mortgage term the balance of the What is an interest only mortgage?Īn interest only mortgage is a secured home loan in which the monthly payments include only the interest on your loan. What is a capital & repayment mortgage?Ī capital and repayment mortgage is a secured home loan that is divided up into repayments of the money you borrowed (capital repayment) and payments of interestĬharges for the loan (interest payments). A selection of frequently asked questions about this mortgage calculator.

0 kommentar(er)

0 kommentar(er)